2024 Millennial Homebuyer Trends

From mortgage rates to available homes to home prices, 2023 was a challenging year for all homebuyers. However, it was especially difficult for millennials or first-time homebuyers to navigate.

2023 is in the rearview mirror, and 2024 is coming up next and we’ve got good news. The latest data indicates a much brighter outlook for the next 12 months.

If you’ve been wondering “Will mortgage rates will cool off?”, “How affordable are home prices?”, or “When will it be a good time to refinance?”, we’ve got the predictions and recommendations you need to see.

Check out our case study, read through our expert analysis, and start your journey to a new home by applying today!

Do you already own a home? Great! If you need relief from a high mortgage payment, you can also start the refinance process to see how much you can save.

Mortgage Rate predictions for 2024

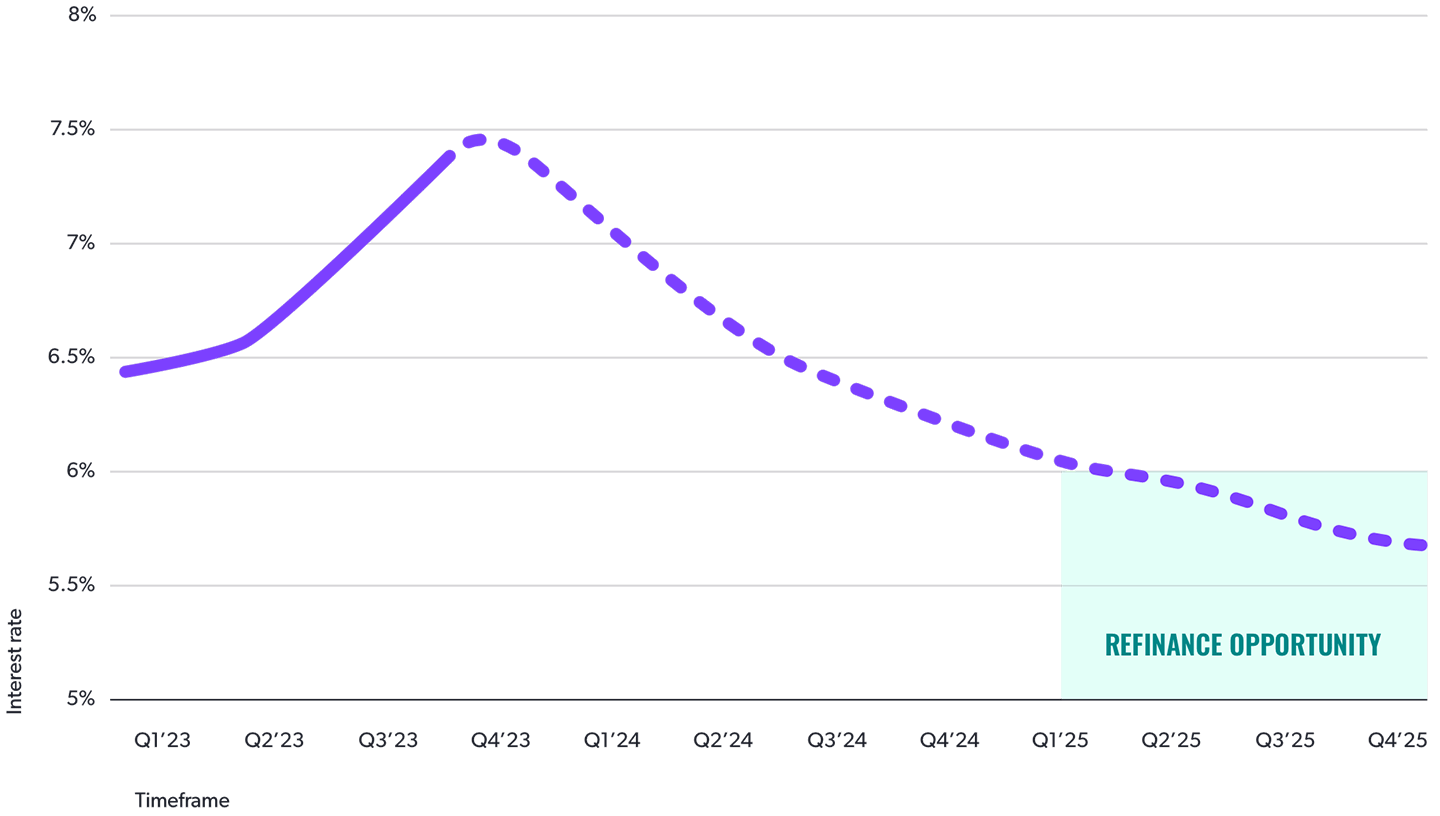

According to a recent prediction (PDF) from the Mortgage Bankers Association, mortgage rates could hit the low 6’s by the end of 2024 and potentially continue into the high 5% range by 2025.

The Federal Reserve appears to be at the end of its tightening cycle, and is expected to start cutting interest rates at some point in 2024.

In a statement from October 15th, 2023, MBA chief economist Mike Fratantoni stated, “The Fed’s hiking cycle is likely nearing an end, but while Fed officials have indicated that additional rate hikes might not be needed, rate cuts may not come as soon or proceed as rapidly as previously expected.”

Fratantoni went on to say, “The job market will likely slow as we enter 2024, with fewer jobs added and the unemployment rate increasing from its current rate of 3.8 percent to 5.0 percent by the end of 2024. Inflation will gradually decline towards the Fed’s 2-percent target by the middle of 2025.” This indicates that once the Fed starts to see weakness in the economy, they’ll look to make a change in interest rates. However, the sooner the Fed starts to cut interest rates, the sooner mortgage refinance will become a more attractive to homebuyers that took on mortgages with rates at 7% or higher.

Once rates start to soften a bit ideally mid to low 5s and 6s (in some cases) I think we will start to see more cash out refinances for those looking to consolidate debt and those looking to get a lower rate if they purchased in late 2022 and 2023 who have rates in the 6,7, and 8% range.

Kia Gostovic

Senior Mortgage Specialist

NMLS# 1598344

How Can Millennial Homebuyers Navigate Mortgage Refinance?

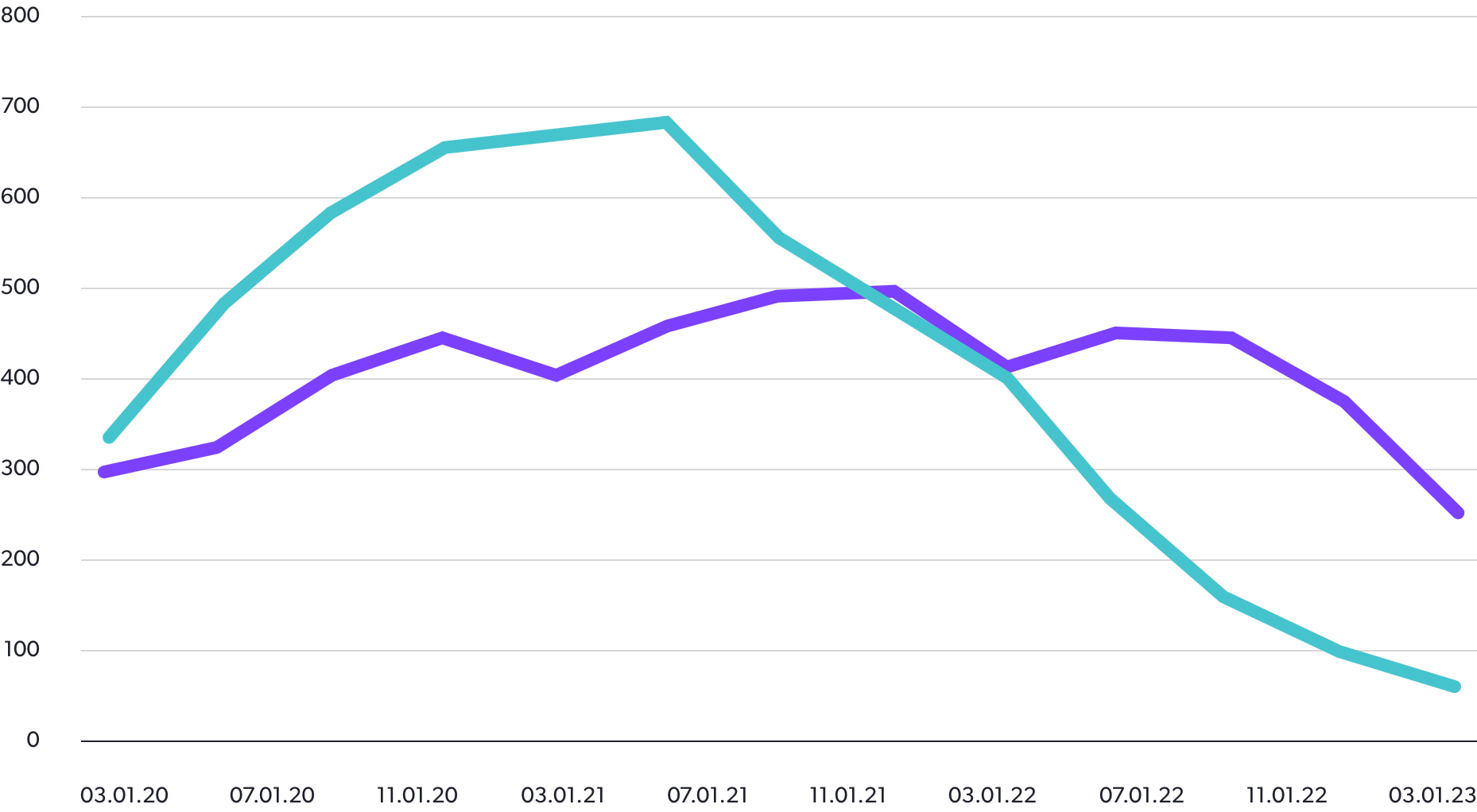

In 2020, mortgage refinancing boomed because of low rates and people staying home during the pandemic. Young homeowners refinanced mortgages to reduce monthly payments and make living costs more manageable. According to a study, refinance activity accounted for 45% of all loans closed by millennial homebuyers in November 2020.

Fast forward to the current market, and the situation has changed…a lot. Millennial homebuyers who missed out on the pandemic boom encountered significantly higher mortgage rates.

However, the situation is still changing. Mortgage rates have come down from their 2023 peak and may come down further depending on market conditions. There may be an opportunity for millennial homebuyers to refinance their homes again in 2024.

Is Refinance or Purchase More Common?

When interest rates are low, a lot of folks lean towards refinancing their mortgages. It’s like catching a good deal – lower rates mean lower monthly payments or a chance to pay off the loan sooner. This refinancing dance happens especially when interest rates hit rock bottom, which we saw happening around the early 2020s.

However, mortgage purchases are what people do when they’re diving into homeownership. It’s like stepping onto the property ladder for the first time. The decision to refinance or buy a home depends on the housing market and interest rates. With rates being historically low a few years ago, refinancing was popular. The recent spike in mortgage rates has kept homeowners away from refinancing. Rates have dropped from their highest point in 2023. There may be an opportunity for current homeowners who recently bought to refinance.

At the moment, the only trend we’re seeing is cash-out refinance** for debt consolidation. That’s still a good idea for folks with significant credit card debt. Even with mortgage rates as high as they are, they’re still lower than credit cards.

Alex Fletcher

Senior Mortgage Specialist

NMLS# 1598344

Which Types of Mortgages Were Refinanced?

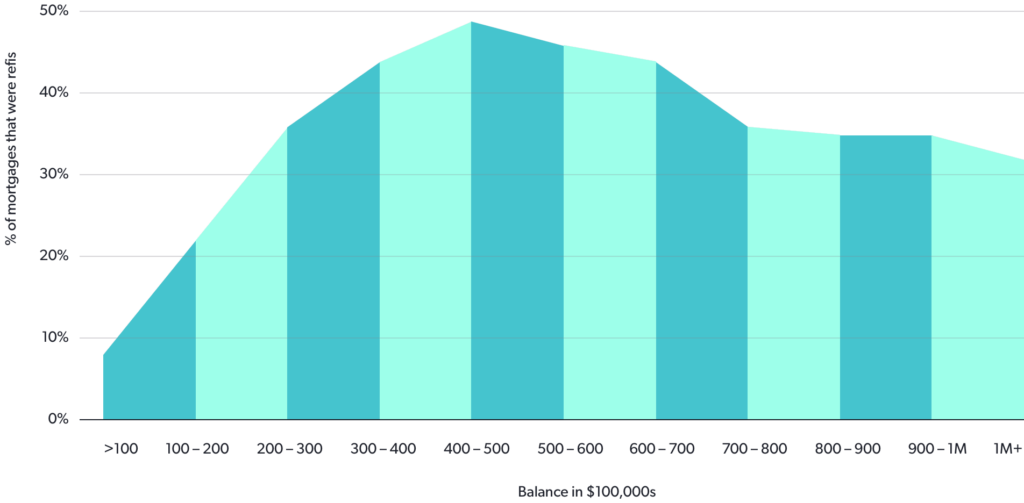

Those mortgages from before 2010? Only about 9% of them got a makeover by 2020. Now, if your mortgage is a little younger, from 2010 to 2014, you’re looking at a 17% chance of a refi. But if your mortgage is from 2015 or later, you’ve got almost a one in three chance of getting a fresh look.

Now, let’s talk about money. The bigger the mortgage balance, the more likely it is to get a facelift. If your mortgage is less than $100,000, there’s less than a 10 % chance it got refinanced.

If your balance is between $400,000 and $500,000, almost half of those got a refresh. Mortgage refinance is less common after hitting the $500,000 mark.

What about government-backed mortgages? FHA mortgages are at 22%, even with their “streamline refinance” option. The real champs here are the VA mortgages – almost 40% of them got refinanced. When we look at the money side again, it turns out higher balance mortgages are more likely to jump on the refinance train. So, whether you’re Fannie Mae, Freddie Mac, FHA, or a VA, a good chunk of those mortgage balances got a new lease on life during this period.

A lot of the loans originated in 2023 could refinanced regardless of type, term, etc. It comes down to what rates look like in the future compared to what originated in ’23. Another thing to keep an eye on are ARM loans.

Matthew McDevitt

Senior Mortgage Specialist

NMLS# 1047440

Millennial Home Buying Trends for 2024

Millennials homebuyers aren’t buying into the same market that their parents had. In 1985, the national average rate for a 30-year, fixed rate mortgage was 12.43%, but the median home price in the U.S. was only $84,300. In Q2 of 2023, the national average rate for a 30-year, fixed rate mortgage was in the 6%-to-7% range. However, the median home price in the U.S. was $402,260.

If you bought at the national averages in 1985, you would pay about $895 a month in principal and interest if you had a 30-year, fixed rate mortgage. In Q2 of 2023, buying a home at the national average with a 30-year, fixed rate mortgage would come with a monthly payment of $2,515 for principal and interest alone.**

Millennial homebuyers still need homes, but the way they go about home purchase is slightly different from other generations. We’ve dug into the data, and come away with several takeaways on how homebuyers in their 20s and 30s get mortgages.

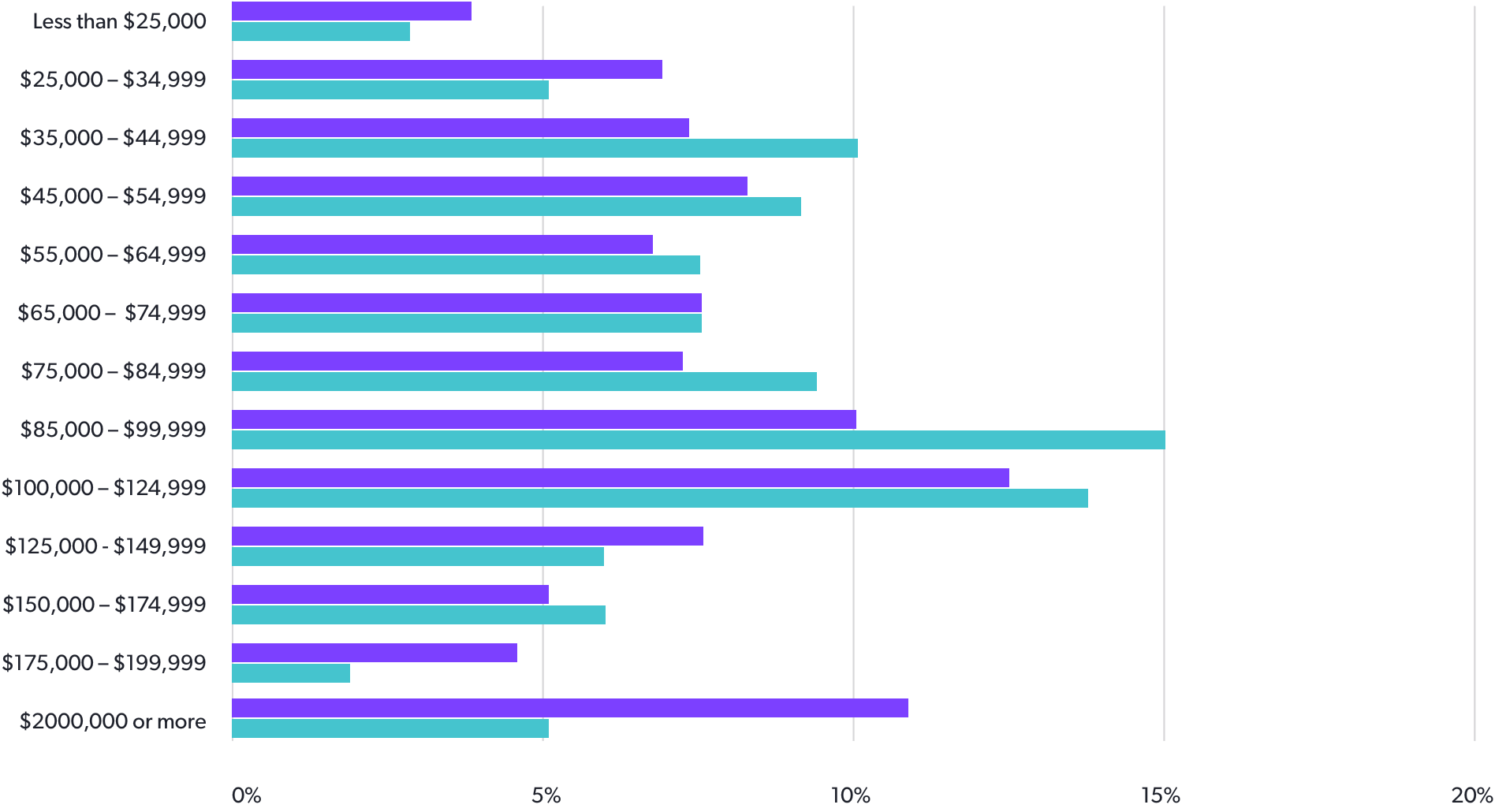

Homebuyer Income

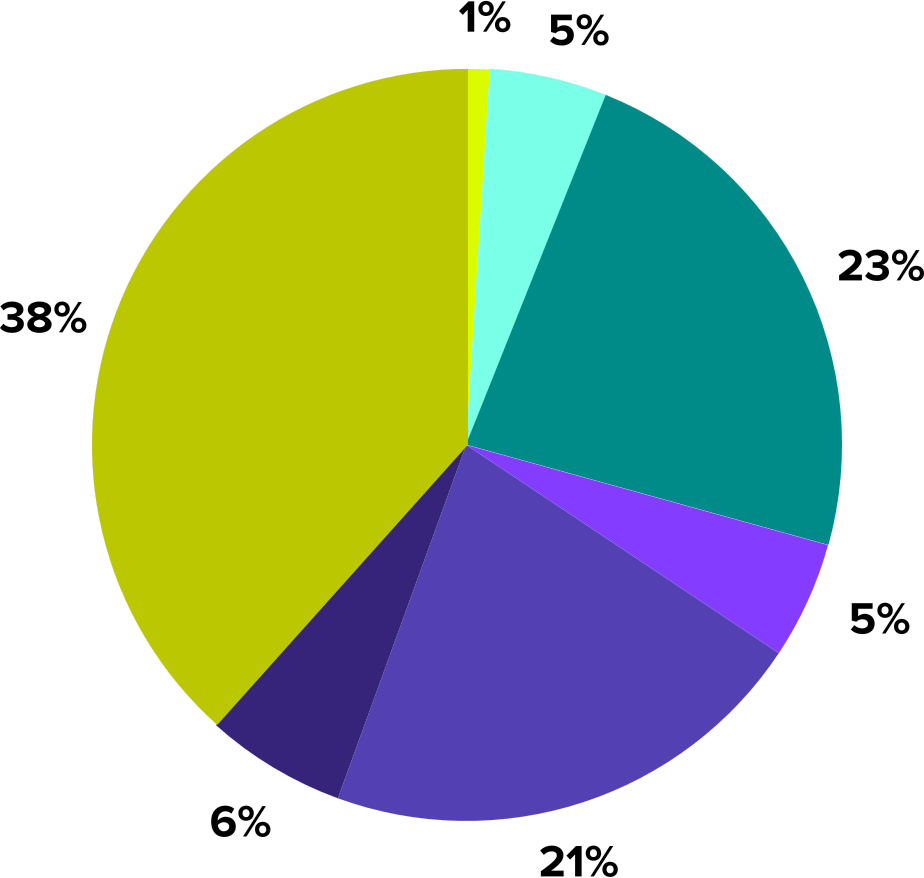

38% of millennial homebuyers earn between $75,000 and $124,999, but only 5% of millennial homebuyers earn more than $200,000 per year.

In 2023, and depending on other factors, millennials are looking for a home under or near the national average to avoid a mortgage payment that would take a large bite out of their monthly income.

Alex Fletcher, Senior Mortgage Specialist (NMLS #1651866), said, “It depends on the market. If they need a two-bedroom, two-bath home, does that mean it’s going to be a $400k purchase in their area versus a $700k in another. When we look at debt-to-income ratio and a few other factors, we can provide what you can expect to pay and see if that works. It’s not always about can they qualify but are they comfortable with that payment.”

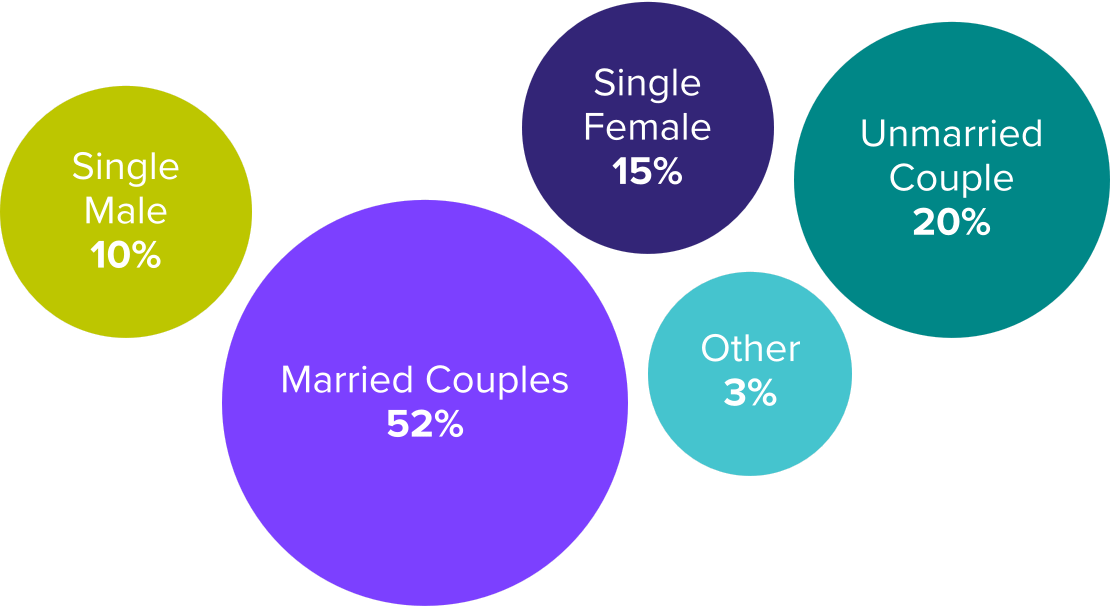

homebuyer household

While over 50 % of millennials households are married couples, 20 % of millennial households are unmarried couples. That’s over double the percentage of all buyers. It’s best to ask if a millennial couple is married than assume.

Fletcher commented, “We see more married and coupled millennials looking to apply from an affordability standpoint. Working with a spouse or partner can just make affording a home a bit easier.”

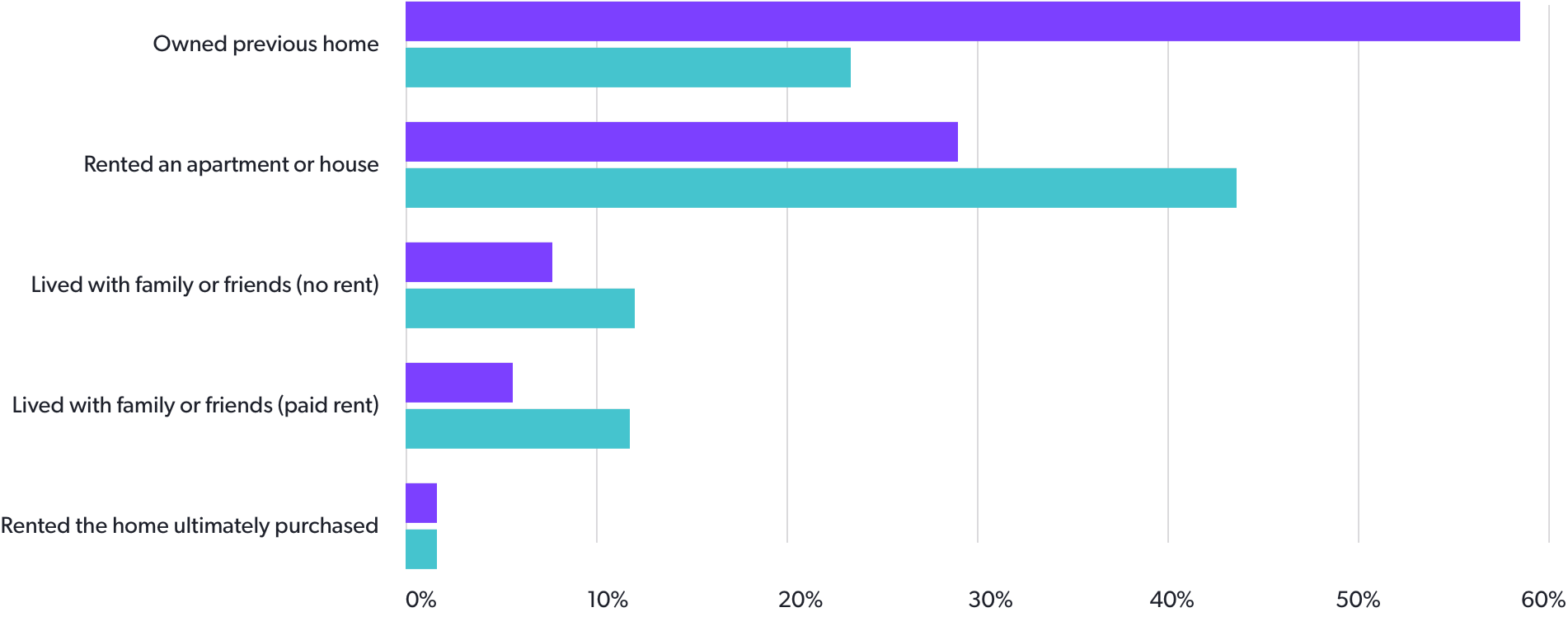

Homebuyer Previous Living Arrangement

The overall percentage of millennial homebuyers that have owned their previous home is less than half of the percentage of all buyers. They’re also more than twice as likely to have either paid rent or lived with family or friends and didn’t pay rent.

Fletcher said, “Setting the expectation between what they pay in rent and what their mortgage payment is needs to match with their expectations. They may not necessarily grasp fully what the mortgage payment might look versus the rental payment.

It’s up to the lender to explain the differences, and help the buyer get comfortable with a potential difference in payment.”

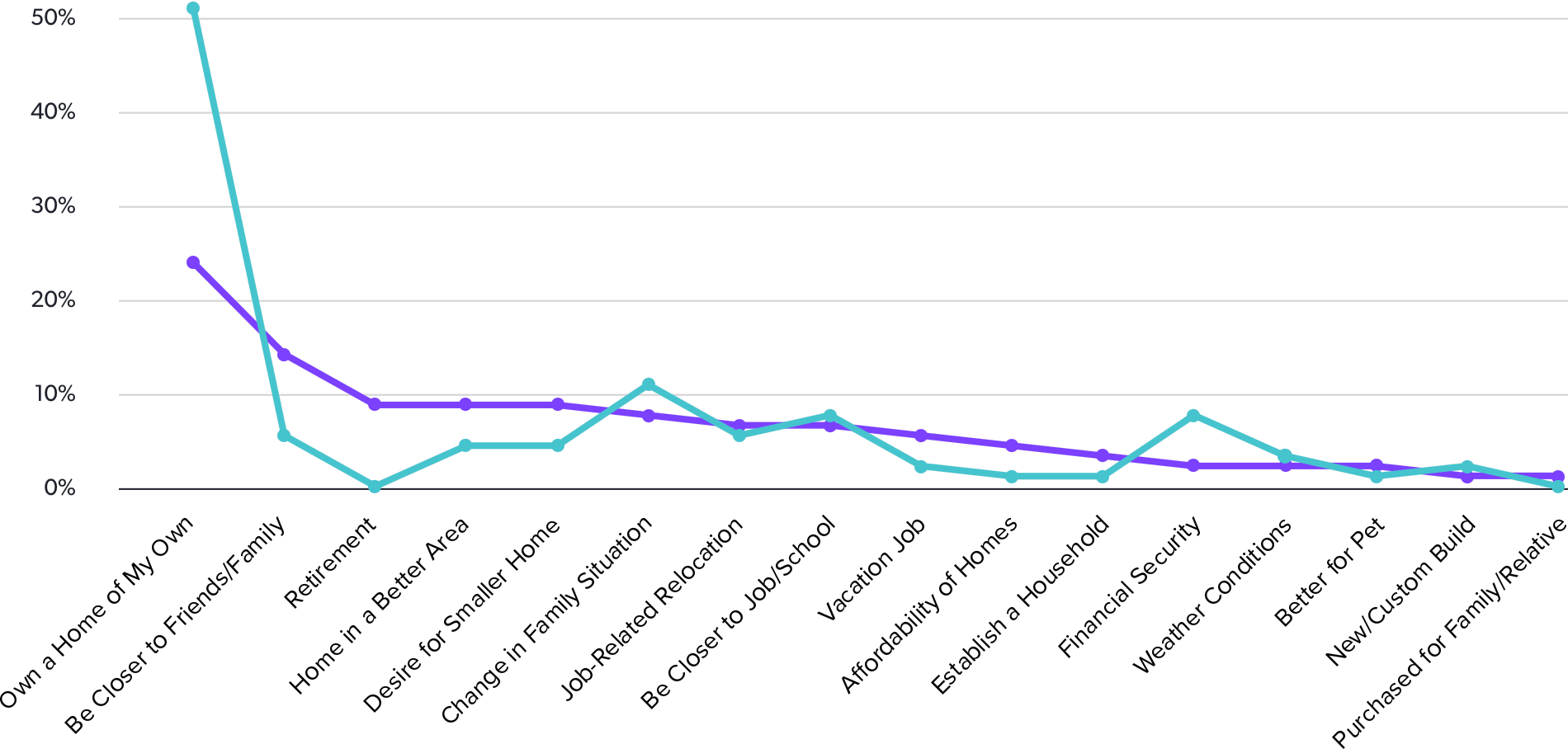

Reason for Purchase

Millennial homebuyers choose a ‘desire to own a home of my own’ as their top reason for pursuing a home purchase more than twice as often than homebuyers from other age groups. It’s clear that wanting a piece of the ‘American Dream’ is still strong with younger homebuyers.

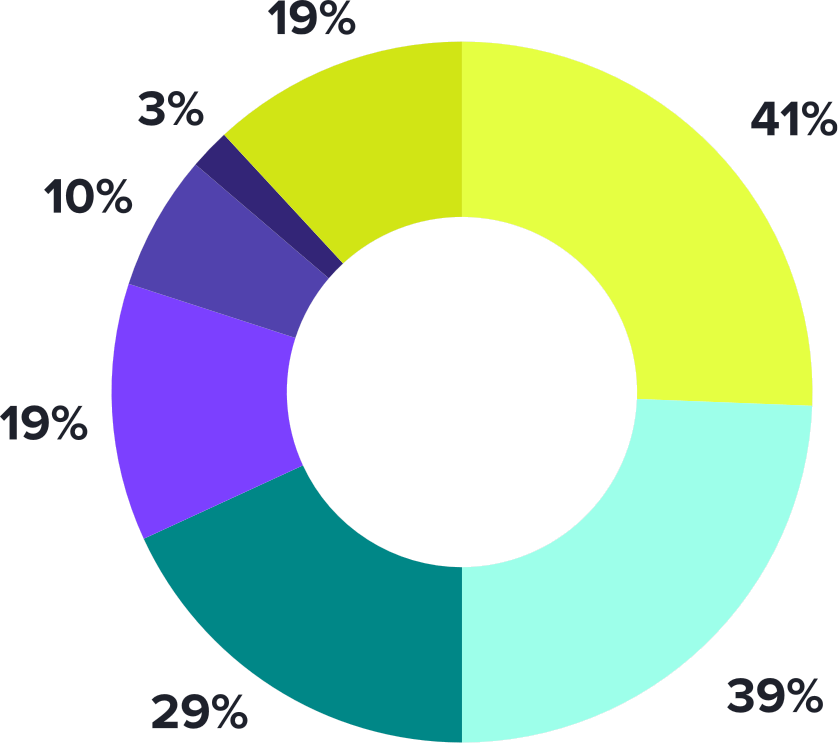

Reason for Timing of Purchase

Over 40 % of millennial homebuyers stated that it was just ‘the right time’ to buy a home. Meaning, they had decided on their living arrangements and saved up the necessary amounts for closing costs and a down payment. Only 1% of millennial homebuyers stated that they wished they had waited to buy, even with current market conditions.

When asked about what the ‘right time’ means, senior mortgage specialist, Kia Gostovic (NMLS #1598344) stated, “The right time is when they can afford everything and still have a little left over. If we go over all the payment and cost info, and it sounds right to them, that means they can move forward. They have all the information and tools they need to buy a house and it’s not stretching them too thin.”

Reason for Buying a New Home

While most millennial homebuyers chose to buy existing homes, those that bought new cited a lack of available existing homes 10% more often than buyers from all age groups. Additionally, they mentioned energy efficiency and ability to customize more often. However, they were among the least likely to choose a new home because of smart home features.

- Avoid renovations

- Lack of inventory

- Ability to choose/customize

- Amenities of new construction

- Energy efficiency

- Smart home features

- Other

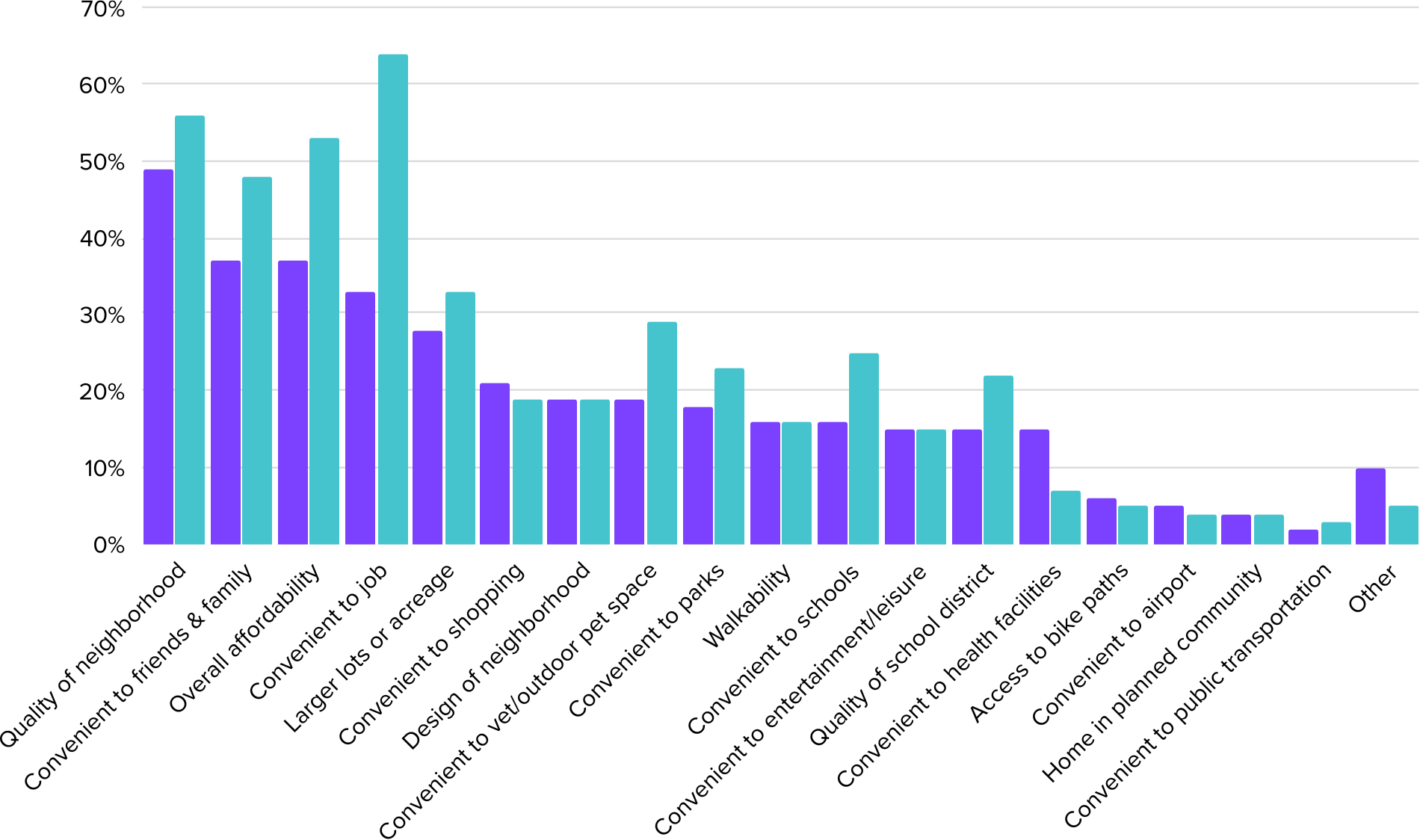

Factors Influencing Neighborhood Selection

While neighborhood quality, and affordability were common answers, millennial homebuyers were more likely to want a home that’s conveniently located near their job, school, or had convenient access to pet-related amenities. They were less likely to want convenient access to health facilities when compared to all homebuyers.

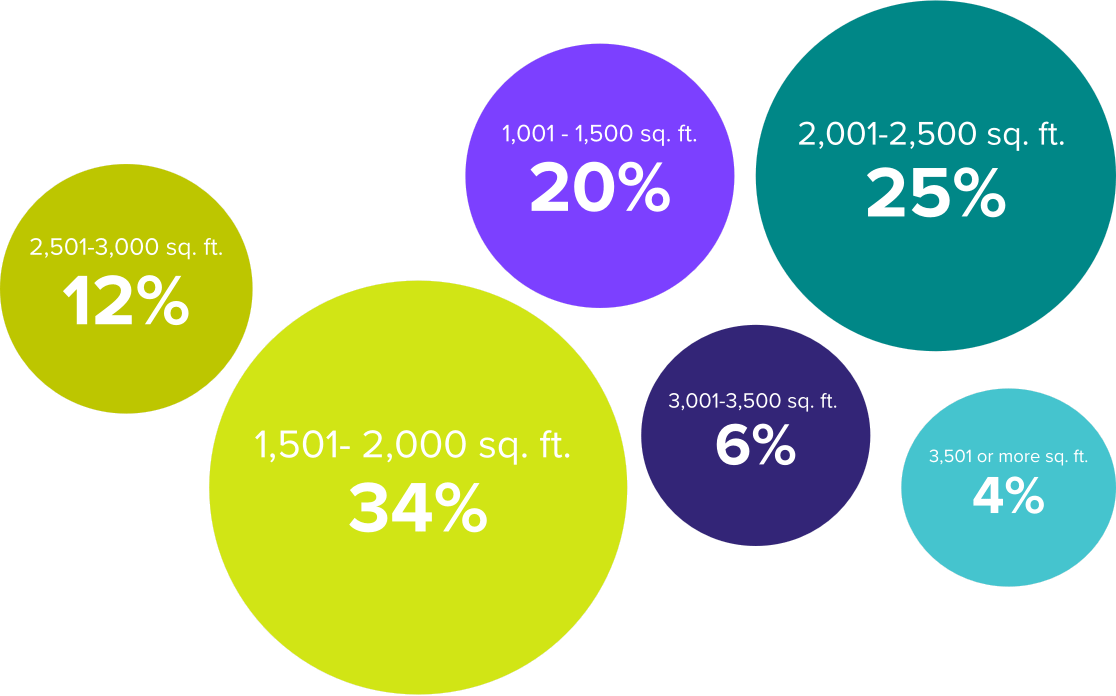

Size of Home

55% of millennial homebuyers choose homes between 1,000 sq. ft. and 2,000 sq. ft. They’re also less likely to look for homes over 3,000 sq. ft. when compared to all homebuyers.

Senior Mortgage Specialist, Matthew McDevitt (NMLS #1047440), said, “Millennial that grew up in suburbs are used to seeing 3,000 sq. ft. McMansions but they are less common and maximizing space seems more en vogue. ‘Bigger is better’ is no longer the case with younger homebuyers. Heating and electricity costs for bigger homes also may not be practical for millennials in the current environment.”

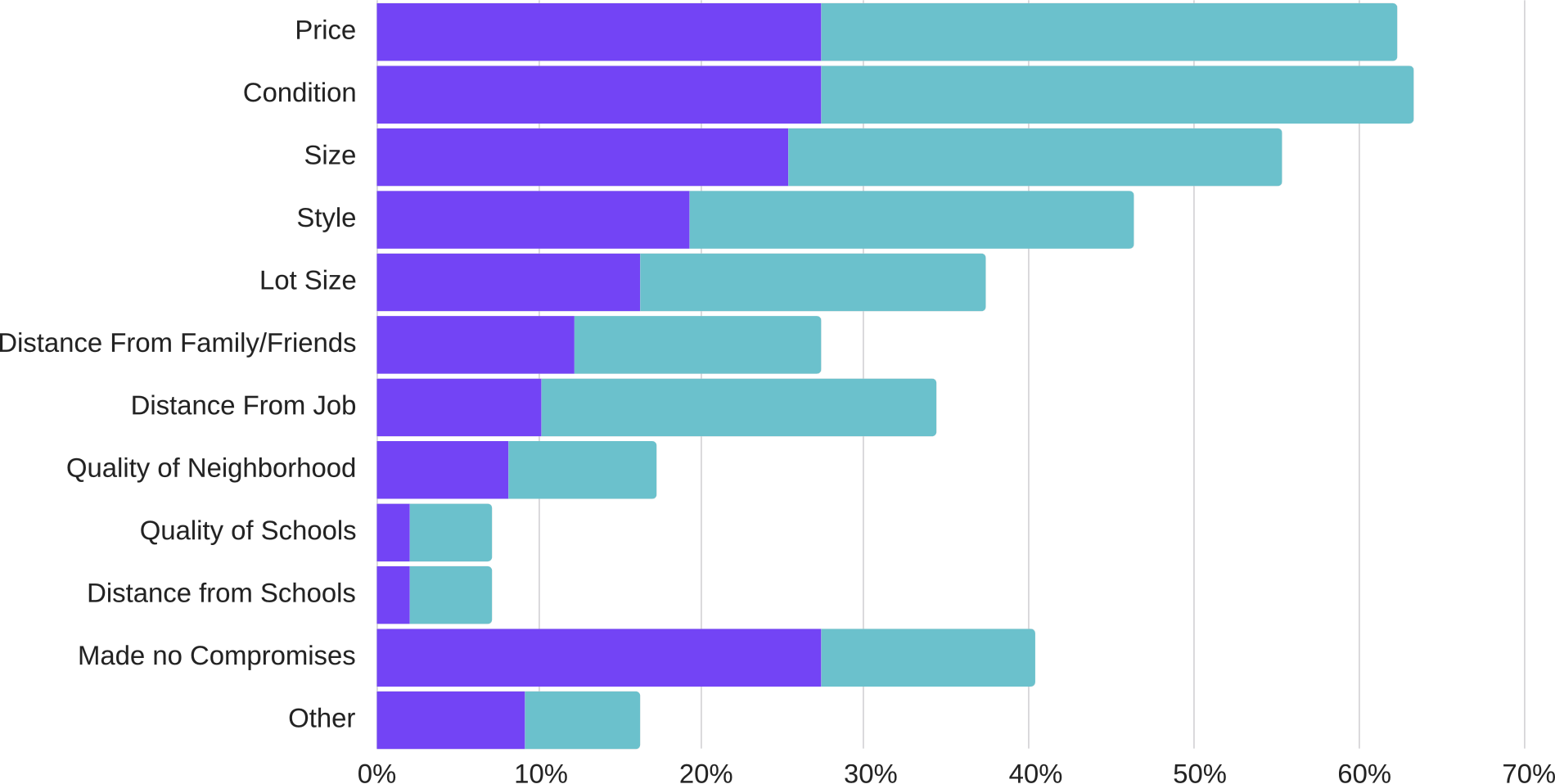

Areas of Compromise

According to the data, millennial homebuyers are more likely to compromise on their home purchase. From the price of the home to the style of the home, millennials are more willing to make compromises when compared to all buyers.

The area that saw the biggest difference between millennial homebuyers and all buyers were distance from job. This is likely due in part to a trend among millennials to prefer to work from home. A recent survey showed that 49% of millennials would prefer to work from home.

McDevitt said, “Verifying employment can be a challenge for remote worker. That’s an aspect of an application that needs to be verified. However, as long as we can verify that and the employer confirms remote work is okay, it shouldn’t make any difference.”

How Long to Stay in Home

While 38% of millennial homebuyers surveyed stated that they wanted to stay in their home for 16 years or more, 50% of all homebuyers showed a desire to call their current home a ‘forever home’.

In another departure from all homebuyers, only 23% of millennials stated that they only wanted to stay in their home for four-to-five years. The idea of a ‘starter home’ clearly exists but is it reality?

- 1 year or less

- 2 – 3 years

- 4 – 5 years

- 6 – 7 years

- 8 – 9 years

- 11 – 15 years

- 16 years or more

I hear most millennials saying that within five years they’re looking to move on. Looking to get into a 30-year, fixed-rate and staying away from buying points is a good idea if you’re looking to stay in a property for few years and move on.

Ben Teasley

Senior Mortgage Specialist

NMLS# 71675

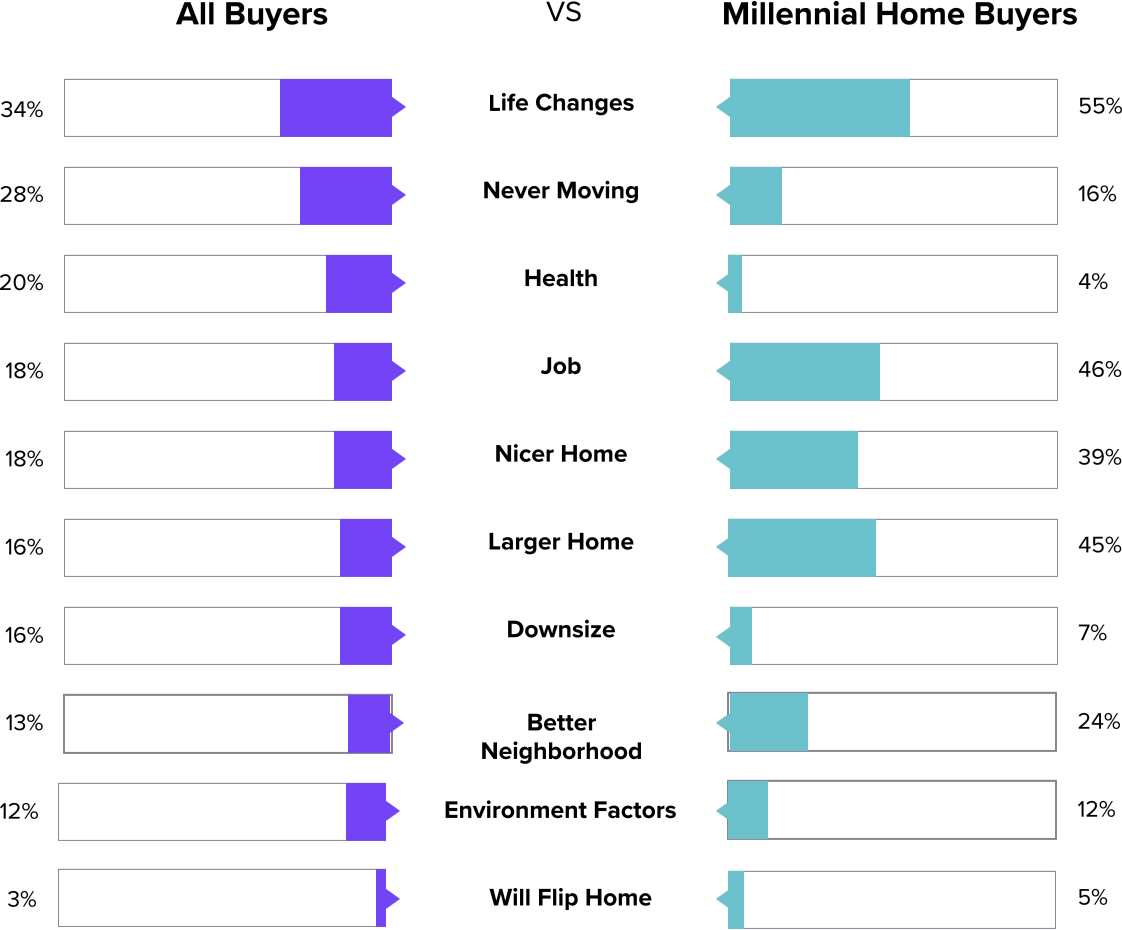

Reasons to Move

Millennial homebuyers differed with homebuyers from most other categories when it comes to reasons to move. Millennials are twice as likely to have to move with a job, want a nicer home, or want a larger home.

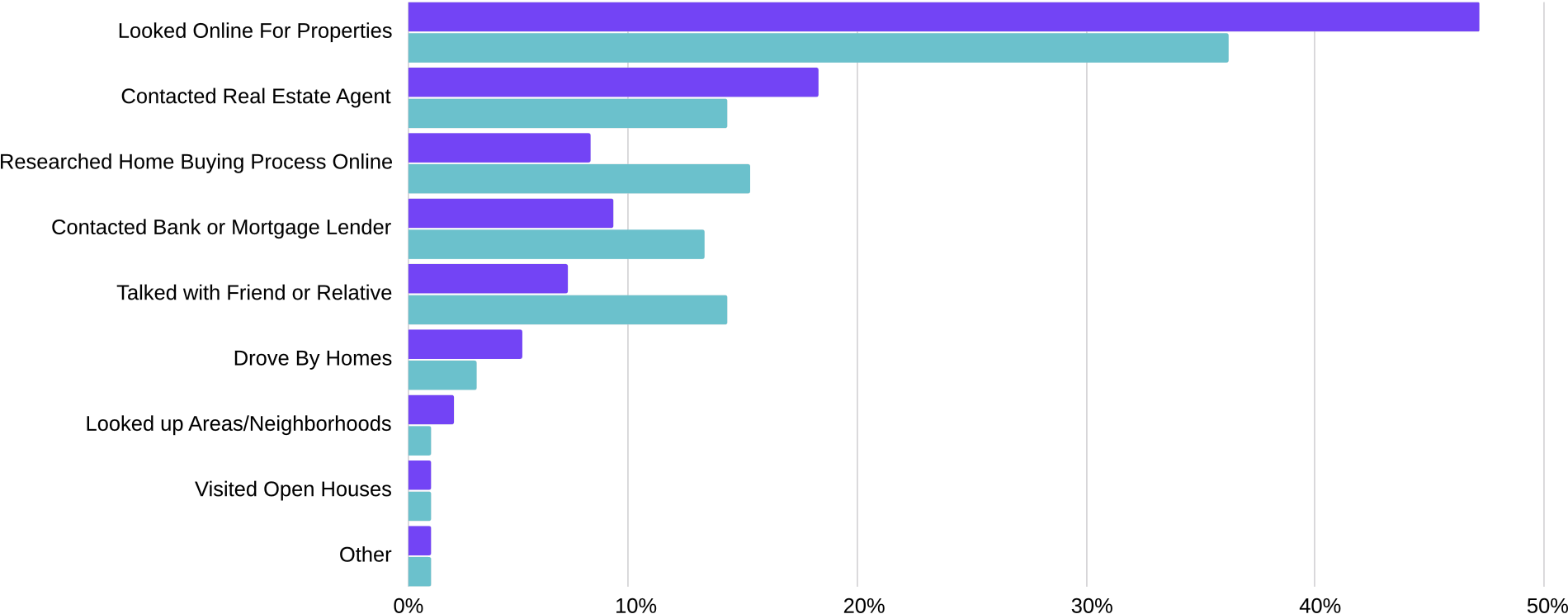

First Steps

55% of millennials went online for properties first. This represents a 21% difference when compared to all homebuyers. They also looked more towards a lender first instead of a real estate agent or a seller. They were also twice as likely to look up neighborhood information before contacting anyone.

Gostovic said, “Everyone Googles nowadays so everyone ‘has a basic understanding’ However, they shouldn’t be contacting an agent before they have an idea of what they can afford. The types of questions that should be asked are, ‘What do we qualify for?’, ‘What can we afford as a monthly payment?’, or ‘Which houses should we be looking at?’ A mortgage specialist can help answer these questions.”

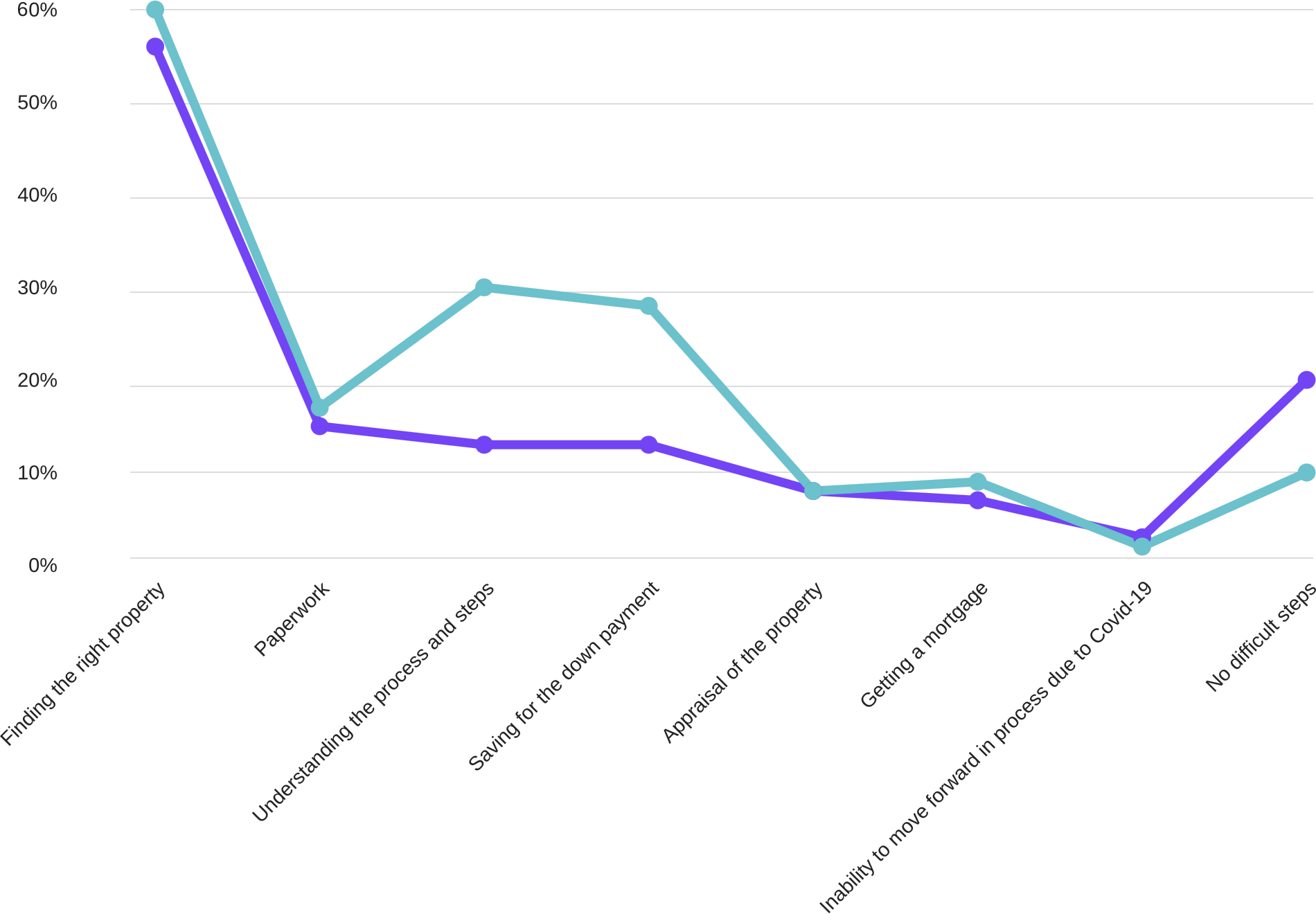

Most Difficult Aspects of Home Purchase

When it comes to difficulty in the homebuying process, millennial homebuyers were twice as likely to have challenges understanding the process or saving for a down payment.

While 60 % of millennials surveyed reported that they faced difficulty with finding a property, it’s clear they’re not alone. 53% of all homebuyers shared similar frustrations, so this isn’t a challenge that only millennials are facing.

Teasley stated, “A good lender can walk a home buyer through the process. Our job is teaching and communicating the process. Millennial homebuyers tend to not understand the costs as well as older homebuyers. For example, they would have a specific down payment in mind and that number might be too low to afford a home in the current environment.”

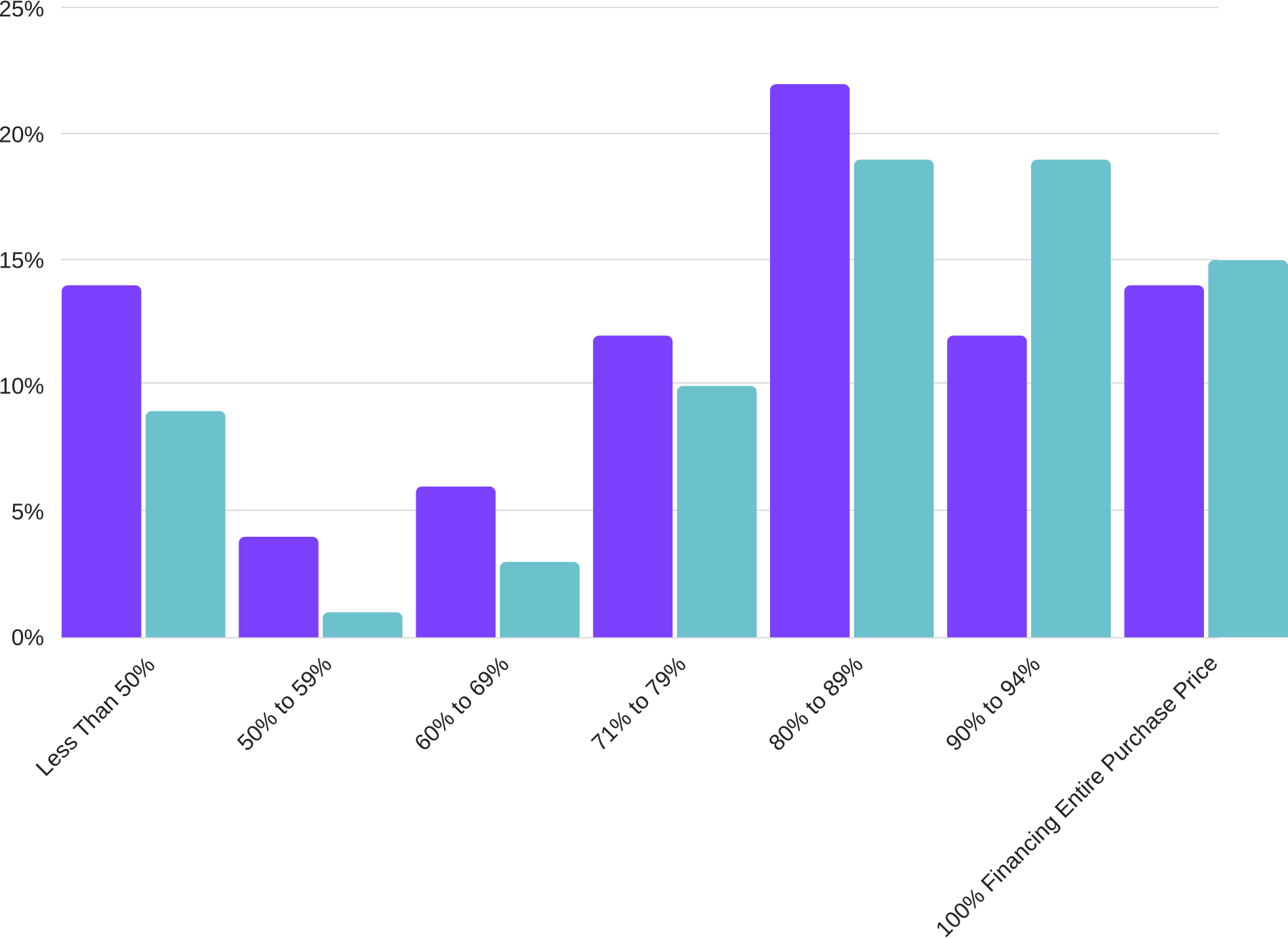

Percentage of Home Financed

Millennials were more likely to finance larger amounts of their home instead of putting money down. Logically this makes sense as millennials are still in the first few years of their professional career, and are less likely to have saved large sums of money needed to make a down payment larger than 20% of a home’s price.

So, should millennial homebuyers try to put more money into their down payment? McDevitt suggested the following, “The question you should ask is yourself is, ‘what’s your comfort level?’”

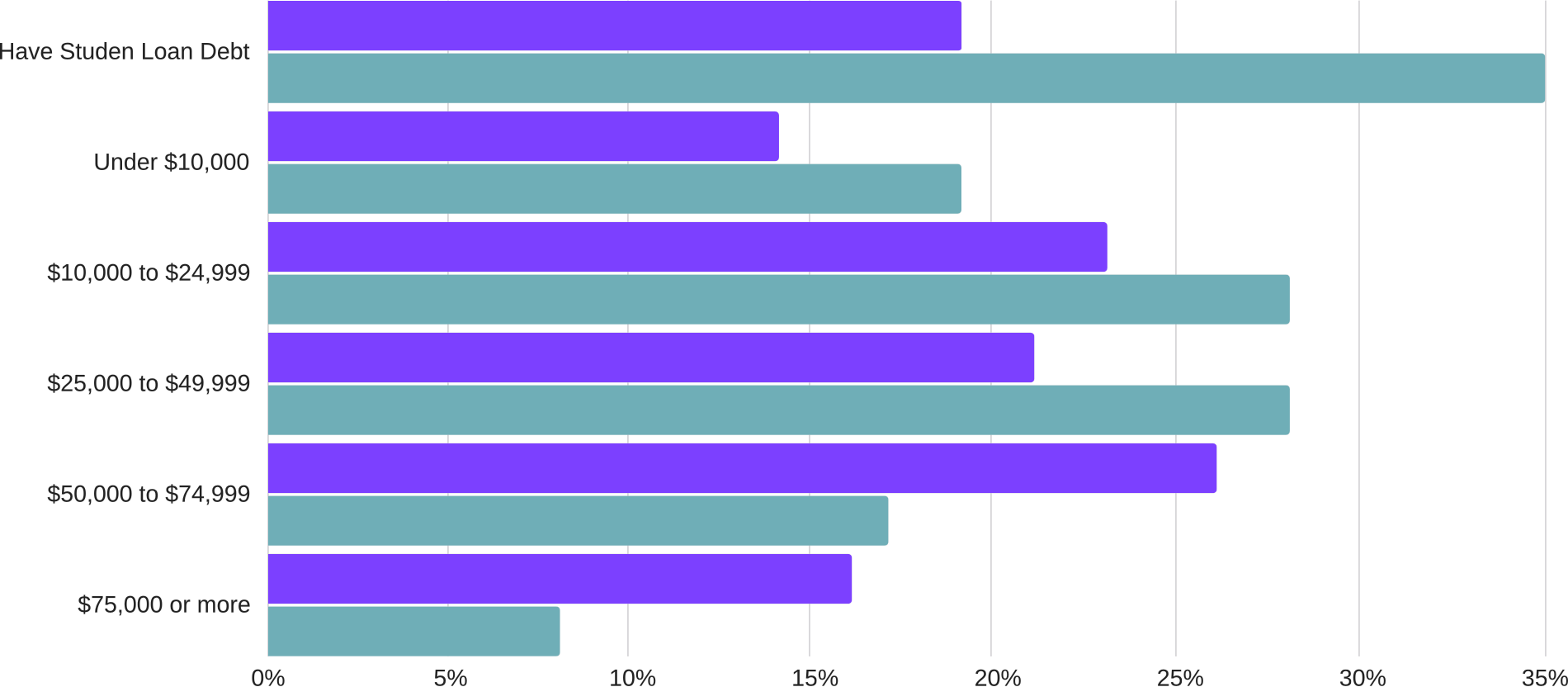

Buyers Who Have Student Loan Debt

35% of millennial homebuyers also carry some student debt. However, they tend to carry less debt than other homebuyers, with 75% of millennials having $49,999 or less student debt, while 42% of all homebuyers carry $50,000 or more in student debt.

When asked for advice on student loan debt, McDevitt offered the following advice, “Don’t pay it off without talking to a mortgage lender. Things could change if laws change, but it all depends on how the debt is structured. Is it in deferment? Is it in an income-based payment plan? Fully amortizing? A good lender will be able to tell, based on status, how much you’re likely to be able to afford. It really depends on the situation and individual circumstances. Talk to your lender first, figure out where it lands on an individual level, and take it from there.”