California mortgage Calculator

California Calculates Mortgages A Bit Differently

Monthly payments calculator

Today’s Rate

- 5.750%

- Rate

- 6.191%

- APR

- Principal & Interest

- $895.95

- Taxes

- $315.00

- Insurance

- $131.67

- PMI

- $0

Total Payment $1,342.62

Renting vs Owning calculator

Your cost breakdown

- Renting

- $143,601

- Buying

- $122,083

If you stay in your home for 8 years, renting is cheaper than buyingbuying is cheaper than renting. You’ll save $163 per month and in total.

Potential savings calculator

Owning

- $2000

- Monthly Payment

- 5.750%

- Rate

- 6.138%

- APR

Others’ average

- $2400

- Monthly Payment

- 6.125%

- Rate

- 6.538%

- APR

Your Potential Savings1

$400

Calculate how much more you can afford

Loan Amount

Potentially how much more home you get

$38,076

What goes into a mortgage payment in California?

Credit Score

How can I improve my credit score?

Your credit will directly impact your mortgage rate. A higher credit score shows that you’re less of a risk to a lender and has the potential to help you qualify for a lower rate on your mortgage.

Loan type & Term

Which type of mortgage should I get?

Your loan term can have an impact on your monthly payment. Assuming the home cost and mortgage rate are similar, a 30-year term will come with lower monthly payments than a 15-year mortgage. However, you’ll pay more in interest during the life of a 30-year mortgage than you will with a 15-year mortgage.

Owning specializes in 30-year, fixed-rate mortgages under $750,000 for borrowers with a credit score over 640. Contact us to learn more about the available options.

Type of Property

Do you know which kind of home is right for you?

Whether you want a condo in the bay area or a single-family home in southern California, we can help you pay for it. If you don’t know the exact property type or area, you can still get pre-approved. Apply today to start the process and show sellers and agents that you’re serious with a pre-approval.

Loan-to-Value (LTV) ratio

Calculating your LTV

Your LTV ratio compares the amount of the loan to the appraised value of the property. A lower LTV ratio can help your secure more favorable loan terms.

Debt-to-income (DTI) ratio

Calculating your DTI

Lenders review your financial situation, which your debt-to-income ratio plays a key role in. Your DTI compares your monthly debt payments to your monthly gross income. A lower DTI shows better financial health, and can help you secure more favorable mortgage terms.

Loan Amount

Do you know how much you’ll have to borrow?

A higher loan amount may come with a higher mortgage rate due to the increased risk for the lender. Figure out how much you can comofortably borrow with our home affordability calculator.

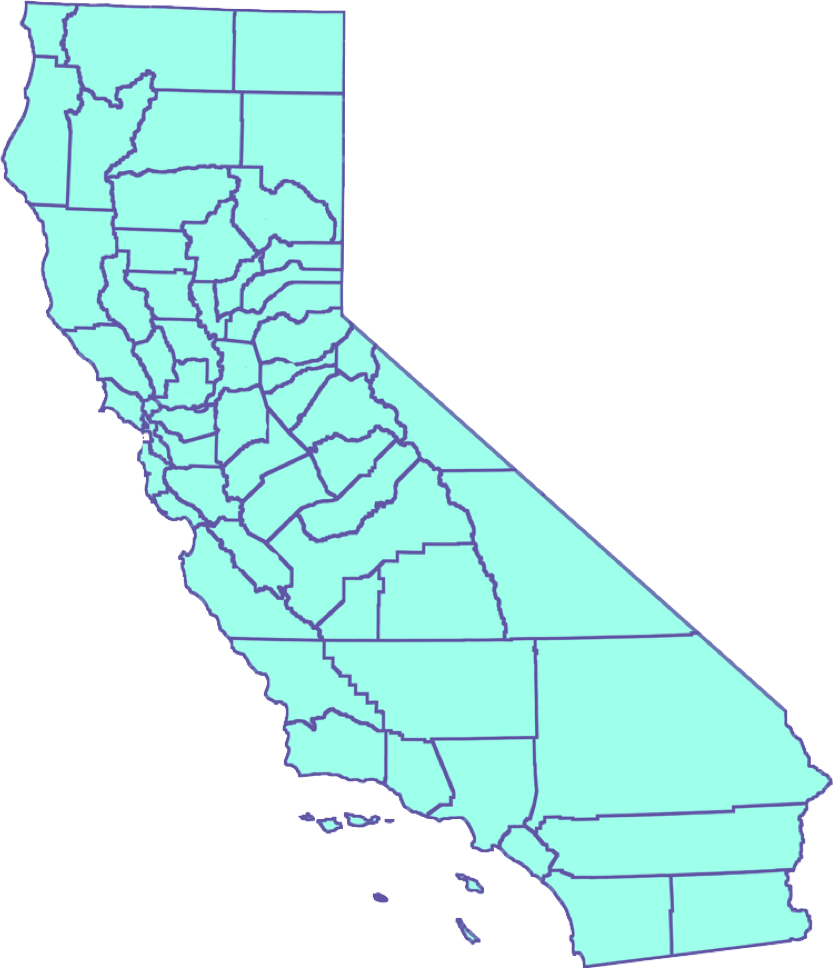

How much are property taxes in California counties?

While California does have property tax, the average effective tax rate is actually below the national average. In 2022 the average effective property tax rate in California was 0.71%. Nationally, the average was 0.99%. However, the property tax does vary from county to county, and home prices in California can be a bit higher than most of the country.

According to data from the California state government, property taxes in California counties are below. Keep in mind, that assessed values don’t update often. You may pay a different rate than what we have listed. *

| County | Median home range* | Average Property Tax Rate** | Median Annual Property Tax Cost |

|---|---|---|---|

| Los Angeles | $890,716 | 1.25% | $11,133.95 |

| San Diego | $934,402 | 0.87% | $8,129.30 |

| Orange | $1,029,214 | 0.79% | $8,130.79 |

| Riverside | $609,299 | 1.04% | $6,336.71 |

| San Bernardino | $571,856 | 0.90% | $5,146.70 |

| Santa Clara | $1,082,135 | 0.85% | $9,198.14 |

| Alameda | $1,077,467 | 0.88% | $9,481.71 |

| Sacramento | $550,422 | 0.93% | $5,118.92 |

| Contra Costa | $875,183 | 0.95% | $8,314.23 |

| Fresno | $424,915 | 0.93% | $3,951.71 |

| Kern | $361,090 | 1.23% | $4,441.40 |

| Ventura | $872,457 | 0.78% | $6,805.16 |

| San Francisco | $1,464,880 | 0.74% | $10,840.12 |

| San Joaquin | $553,133 | 0.98% | $5,420.70 |

| San Mateo | $1,582,169 | 0.73% | $11,549.83 |

How much does homeowners insurance cost in California

A variety of factors influence the cost of homeowners insurance in California, just like other states. Whether you live on the coast, in one of the major cities, or in the mountains, there are multiple aspects of your home that impact your homeowners insurance payment.

These factors help insurers assess the risk associated with your home and determine the price you pay for coverage. Here are some key factors that go into determining the cost of homeowners insurance in California:

How can I start a mortgage application on a home in California?

Do you know that buying a new home in California is the right move for you? Once you’ve calculated your mortgage payment, you can start your journey to your California dream home by getting a mortgage pre-approval.

Getting a pre-approval is a great way to show sellers and real estate agents that you’re a serious buyer. It also gives you an idea of what you’re likely to get approved for. Check out the current mortgage rates and apply today!

*Owning does not provide tax advice. Contact your tax adviser with any tax related questions.

https://www.nar.realtor/research-and-statistics/housing-statistics/county-median-home-prices-and-monthly-mortgage-payment

**https://smartasset.com/taxes/california-property-tax-calculator